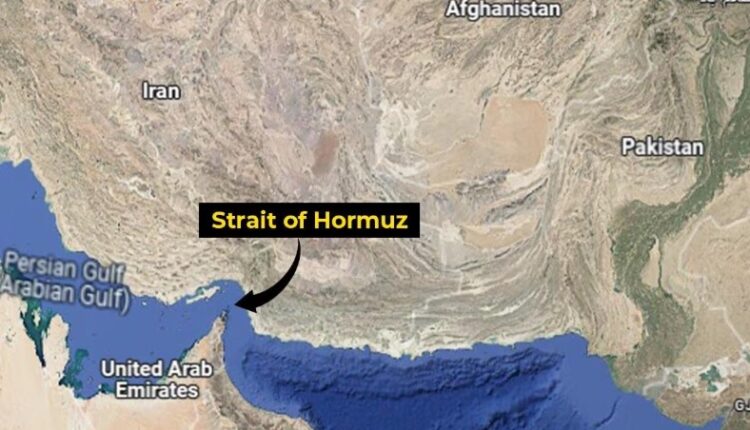

In the global crude oil market, oil prices rose over two per cent, to their highest level since January this year, in early trade today. This spike in prices came after the US strikes on nuclear facilities in Iran. Iran has been threatening to shut the Strait of Hormuz, through which around 20 per cent of global crude supply flows, triggering widespread concerns. Meanwhile, Brent Crude was trading almost 0.7 per cent up at 77 dollars and 54 cents per barrel, while WTI Crude was trading over 0.6 per cent up at 74 dollars and 34 cents per barrel, when reports last came in.

Meanwhile, most Asian markets tumbled in the intra-day trade today. Indonesia’s Jakarta dropped over two per cent, Taiwan Weighted index shed more than 1.4 per cent, Singapore’s Strait Times index was trading over 0.3 per cent down, South Korea’s Kospi index dipped over 0.2 per cent, and Japan’s Nikkei 225 index was also trading over 0.1 per cent down, a short while ago. Germany’s DAX futures, France’s CAC futures and London’s FTSE 100 futures were also trading in red when reports last came in.

In the Indian stock market, the benchmark domestic equity indices, Sensex and Nifty, were trading over half a per cent down in the afternoon trade. The 30-share BSE Sensex dropped 466 points, to 81,942, and the NSE Nifty50 lost 117 points, to 24,995, when reports last came in. However, the broader market at the Bombay Stock Exchange was trading in positive territory. The Mid-Cap index advanced by over 0.2 per cent, and the Small-Cap index rose by almost 0.4 per cent, a short while ago.